Lhdn Stamp Duty Calculation

To know how much down payment lawyer fees and stamp duty needed are so.

Lhdn stamp duty calculation. Please contact us for a quotation for services required. Legal fee and stamp duty calculator calculation of legal fees is governed by solicitors remuneration amendment order 2017 and calculation of stamp duties is governed by stamp act 1949. For some people buying a home is a significant milestone that tops many people s lifetime to do lists.

Stamps is an electronic stamp duty assessment and payment system via internet. To calculate how much you need to pay for stamping your tenancy. You can pay for stamp duty at any lembaga hasil dalam negeri lhdn in malaysia for a list of lhdn branches near you go here.

Rental stamp duty calculation tenancy agreement is a printed document that states all the terms and conditions which the tenants and landlords. Calculate stamp duty legal fees for property sales purchase mortgage loan refinance in malaysia. The calculation formula for legal fee stamp duty is fixed as they are governed by law.

Legal fees stamp duty calculation 2020 when buying a house in malaysia. Purchasing and hunting for a house can be an exciting and stressful experience. Please contact us for a detailed quotation as the following tables exclude any taxes disbursements and reimbursement charges.

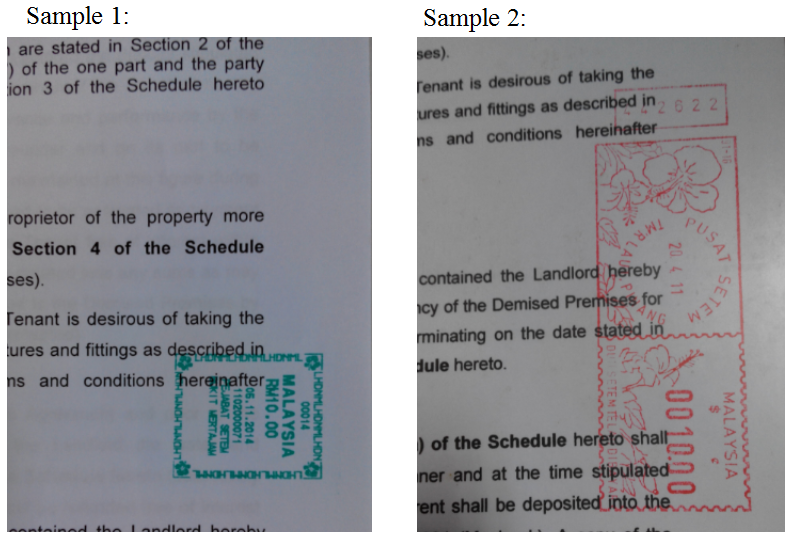

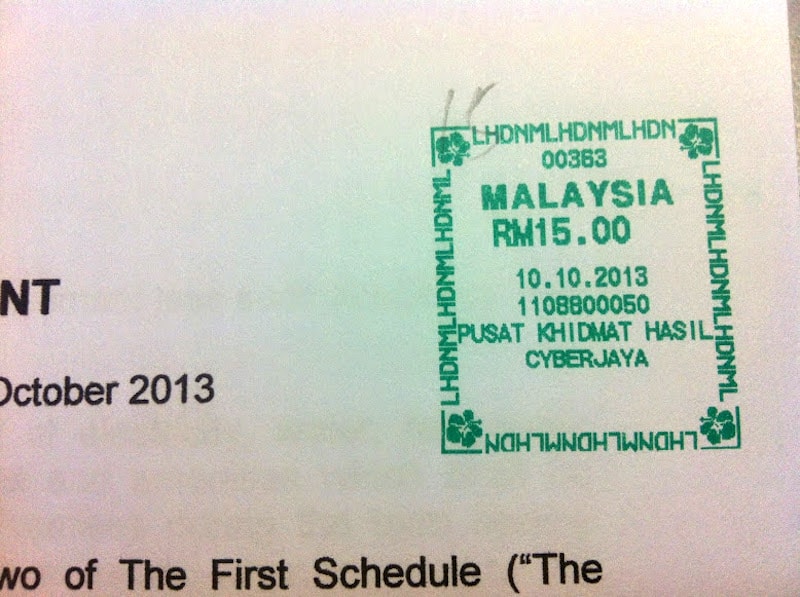

This method will replace the manual system in lhdnm s counter which use franking machine and revenue stamp. Calculate now and get free quotation. There is no hard rule on this as the law doesn t state however conventionally it is the tenant who will bear the cost of stamping fee but some more desperate owner agree to split 50 50 or absorb the cost to secure.

Who pays for the stamp duty tenant or landlord. Stamp certificate stamp certificate in relation to the instrument to the value of the duty paid is issued electronically where stamping application is done online via the internet at lhdnm website https stamps hasil gov my. You can get it done at malaysia inland revenue authority also known as lembaga hasil dalam negeri malaysia lhdn malaysia.

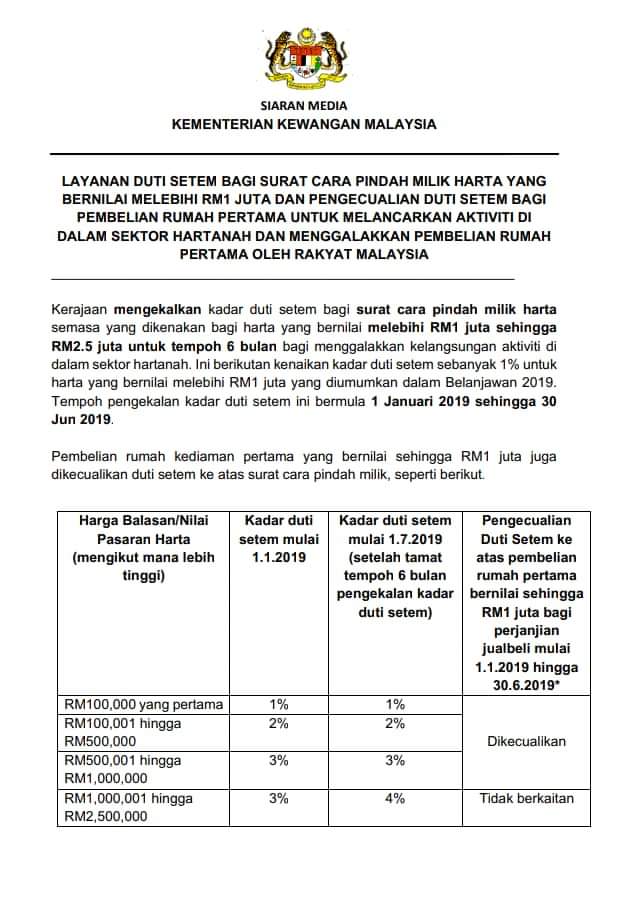

The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 july or later.