Lhdn Tenancy Agreement Stamp Duty Calculation

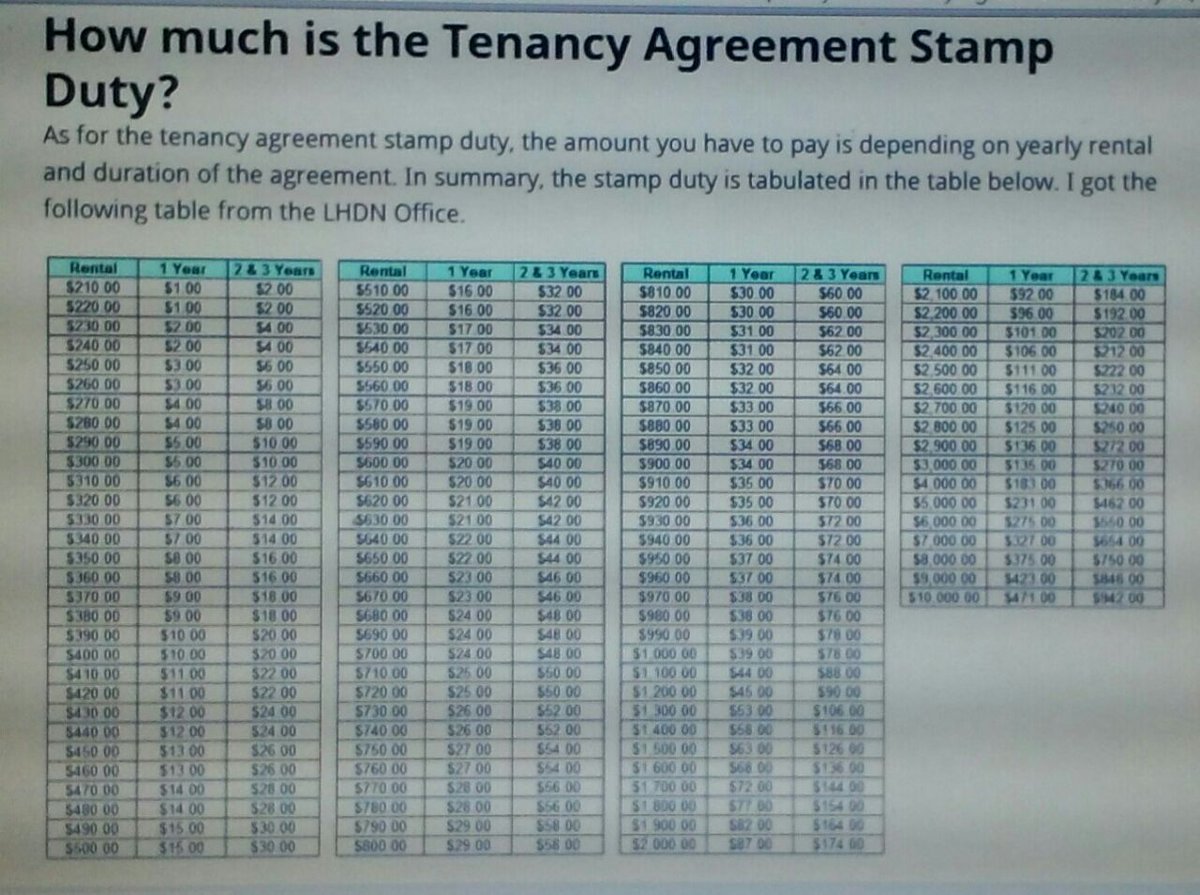

In summary the stamp duty is tabulated in the table below.

Lhdn tenancy agreement stamp duty calculation. Feel free to use our calculators below. For example by clearly stating that the tenant is responsible for all payable charges such as water. The amount of the current stamp duty payable is computed according to the information that you have entered.

Tenancy agreement i s a printed document that states all the terms and conditions which the tenants and landlords have agreed upon before the tenant moves in. Common stamp duty remissions and reliefs for property at a glance scenario for which remission can be considered on a case by case basis appealing for stamp duty waiver. The stamp duty for sale and purchase agreements and loan agreements are determined by the stamp act 1949 and finance act 2018 the latest stamp duty scale will apply to loan agreements dated 1 january 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 july or later.

Importance of tenancy agreement stamping. Online calculator to calculate tenancy agreement stamp duty. It is very crucial for property leasing in order to protect the landlords and tenants.

I got the following table from the lhdn office. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law. How much is the tenancy agreement stamp duty.

The amount of stamp duty currently payable on the instrument will be shown. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Please input the tenancy details and then press compute.

Jika anda pernah mengunakan sistem stamps sebelum ini. Please contact us for a quotation for services required. Enter the monthly rental duration number of additional copies to be stamped.

To use this calculator. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949.