Malaysia Employment Act Salary Calculation

Before zooming directly into the ea it is more important to determine the true meaning of wages.

Malaysia employment act salary calculation. 1st june 1957 part i preliminary. If you are paid late or not paid salary. 2 this act shall apply to west malaysia only.

The apportionment continue reading salary calculation. Non payment of salary is an offence. This term holds utmost importance for every employer and employee and bears huge implications should.

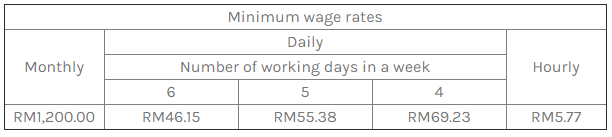

Monthly and daily salary. Annual salary after deductions is the total amount of salary calculator remaining after the total deductions are made on the employee s gross annual salary. The salary of a monthly rated employee is apportioned base on the number of days in the respective calendar month.

From 1 april 2016 employers must keep detailed employment records including salary records of employees covered by the employment act. 2 this act shall apply to peninsular malaysia only. Daily wages are calculated using either the gross rate for paid public holidays paid leave salary in lieu and salary deductions or the basic rate for work on rest days or public holidays.

In this article we will study the laws governing the hours of work and overtime work for employees under malaysia s labour laws. The employment act provides minimum terms and conditions mostly of monetary value to certain category of workers any employee as long as his month wages is less than rm2000 00 and. An act relating to employment.

Federal territory of labuan 1 november 2000 p u. A 400 2000 p art i preliminary short title and application 1. Interpretation 1 in this act unless the context otherwise requires.

But overtime can be a very confusing matter. Salary calculation for incomplete month when an employee joins a company or ceases employment during a month thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. 1 in this act.

Payroll cycle if you are covered under the employment act 1955 your employer must pay your salary at least once a month. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus only tax. 1 this act may be cited as the employment act 1955.

The employment act 1955 is the main legislation on labour matters in malaysia. Definitions and calculation you may receive a monthly or daily salary. Peninsular malaysia 1 june 1957 l n.

If the employee s salary does not exceed rm2 000 a month or falls within the first schedule of employment act. Short title and application 1 this act may be cited as the employment act 1955. An act relating to employment.

Summary of employment laws in malaysia employment act 1955. The employment act 1955 ea of malaysia covers broadly the minimum entitlements of an employee who falls within the purview of the ea.