Malaysia Tenancy Agreement Stamp Duty

And if the tenancy agreement has been signed for more than 3 years the stamp duty rate will be rm3 for every rm250 of the annual rent in excess of rm2 400.

Malaysia tenancy agreement stamp duty. April 1 2019 at 11 27 pm reply. Chat property malaysia author. We recommend you to download easylaw phone app calculator to calculate it easily.

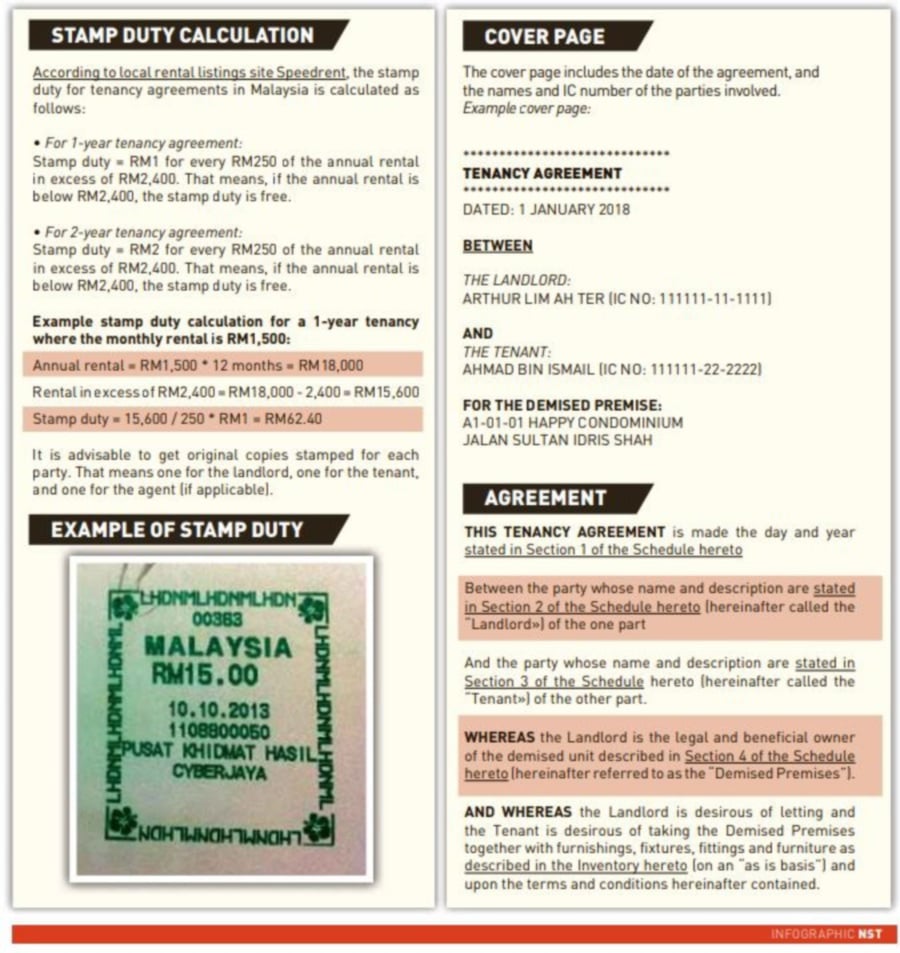

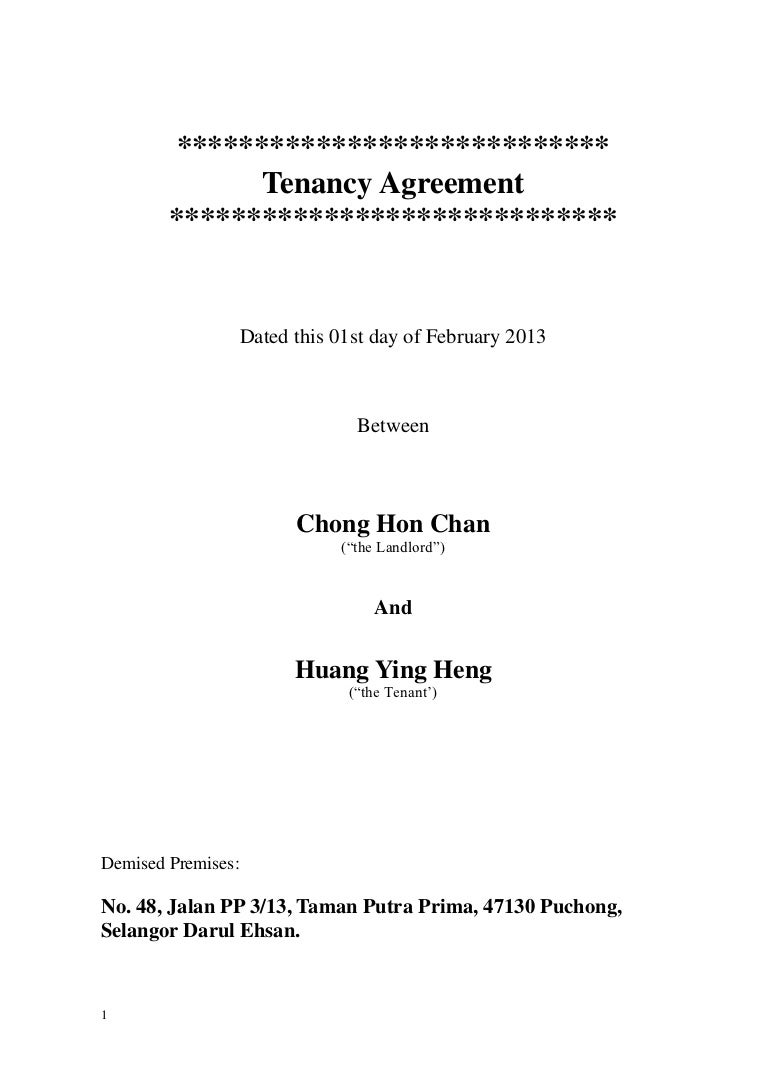

Pds 1 and pds 49 a. While paying the stamp duty there are 2 application forms which you need to submit. The formula for calculating that stamp duty will be.

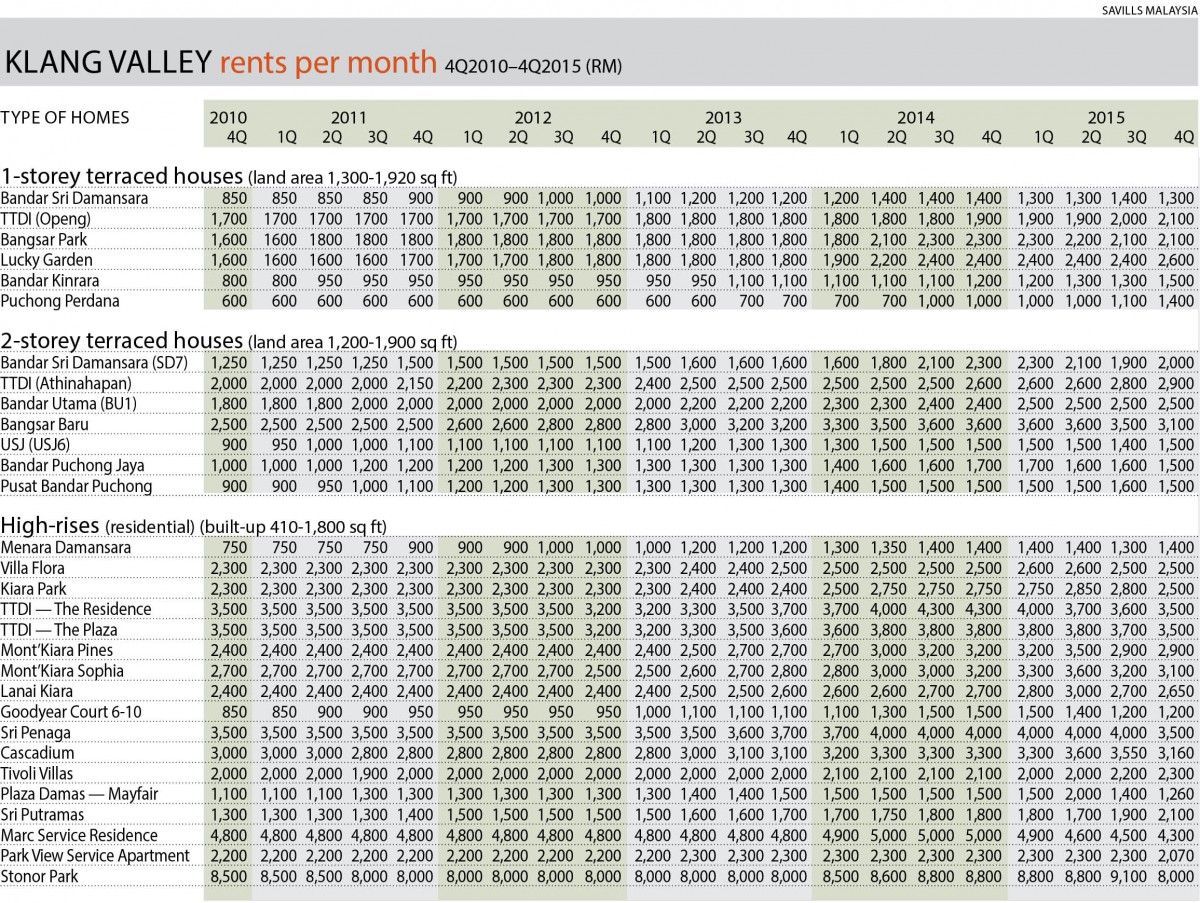

For instance the monthly rental for a one year tenancy is rm2 000 so the annual rent is rm24 000. Instruments liable to stamp duty are those listed in the first schedule of the stamp act 1949 exemptions relief from stamp duty general exemptions under section 35 in first schedule stamp act 1949 and specific exemptions under item 2 4 and 32 in first schedule stamp act 1949. You may check with tax office for clarification.

Pay seller s stamp duty or claim for seller s stamp duty remission for housing developers for agreements relating to disposal of properties. How do i calculate the stamp duty payable for the tenancy agreement. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the.

For second copy of tenancy agreement the stamping cost is rm10. I got the following table from the lhdn office. The standard stamp duty chargeable for tenancy agreement are as follows.

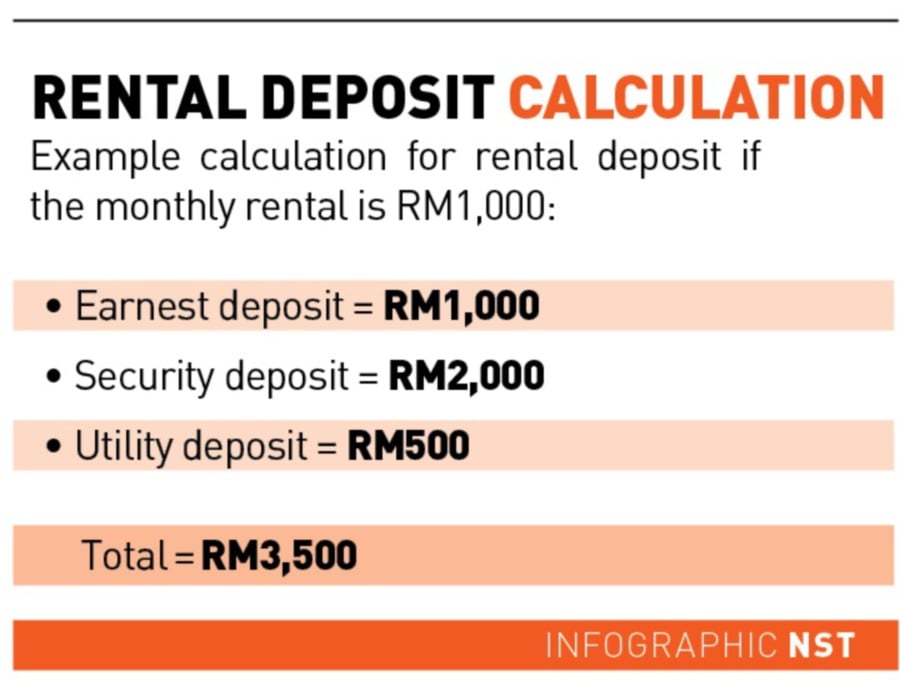

As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Online calculator to calculate tenancy agreement stamp duty. About chat property malaysia.

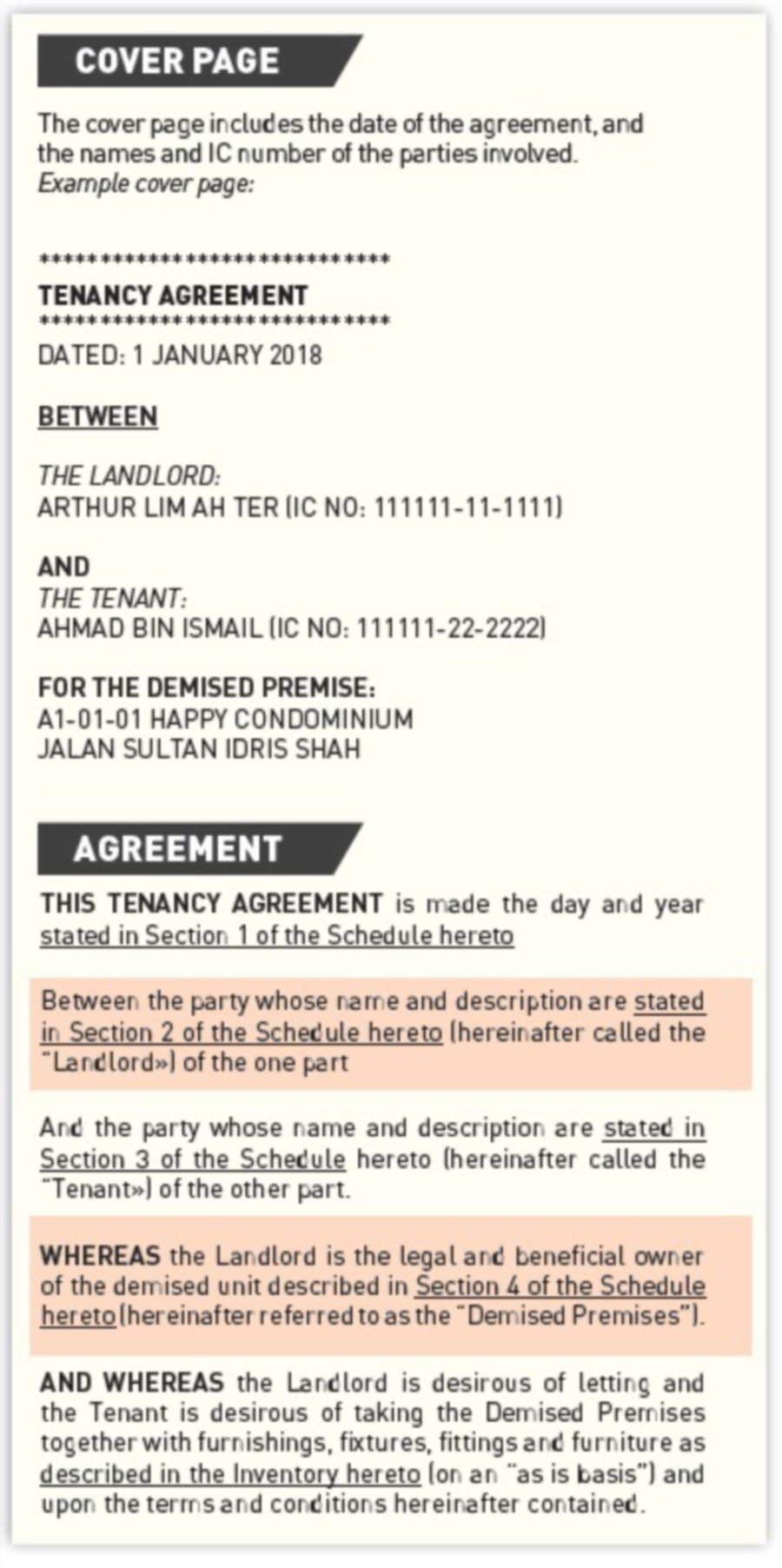

More than rm 100 000 negotiable q. The tenancy agreement will only be binding after it has been stamped by the stamp office. Rm24 000 rm2 400 rm21 600.

Legal fee for tenancy agreement period of above 3 years. To use this calculator. April 17 2019 at 1 33 pm reply.

Next rm 90000 rental 20 of the monthly rent. Sale purchase of property seller s stamp duty note. Can i print the digitally signed tenancy agreement and use it for stamp duty at the tax office.

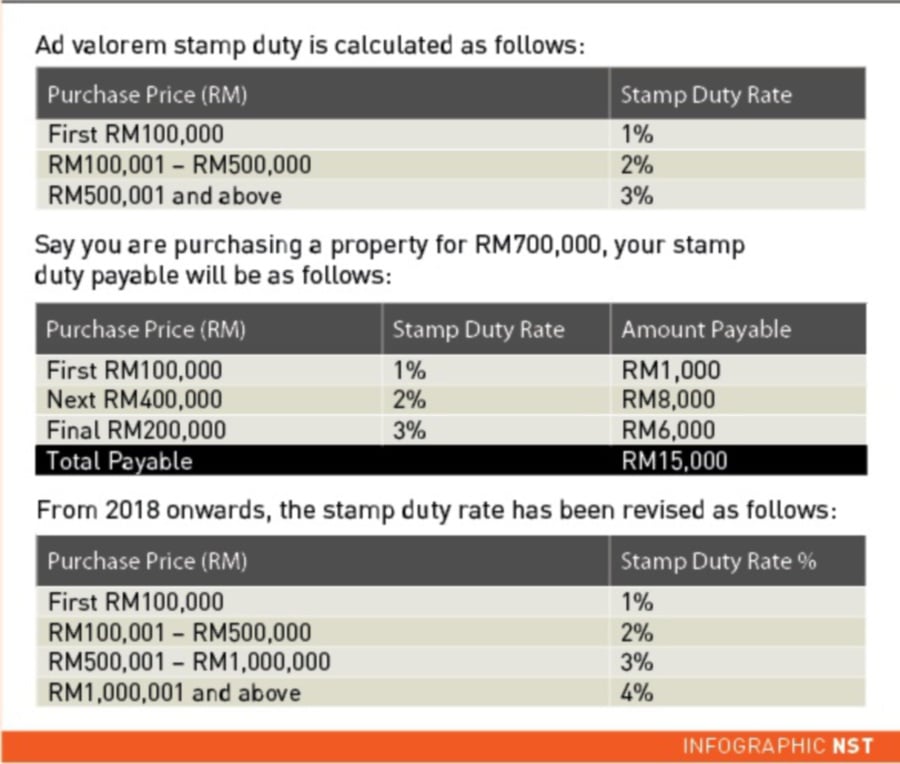

The amount paid would be calculated based on the annual rent. Enter the monthly rental duration number of additional copies to be stamped. Stamp duty is computed based on the consideration paid or the market value of the property whichever is the higher amount.

First rm 10 000 rental 50 of the monthly rent. How do i calculate the stamp duty payable for the tenancy agreement. The standard stamp duty chargeable for tenancy agreement are as follows rental for every rm 250 in excess of rm 2400 rental.