Mobile Payment Malaysia Statistics

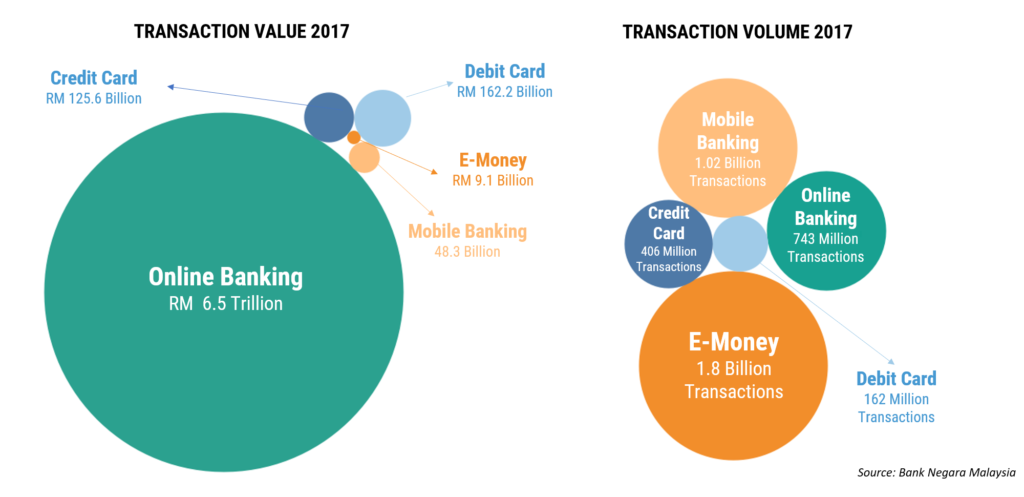

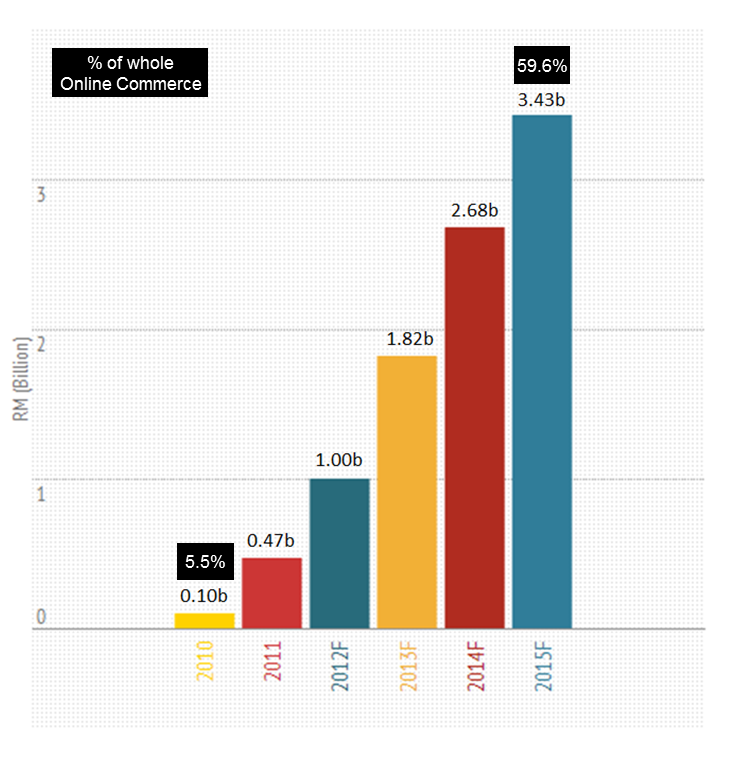

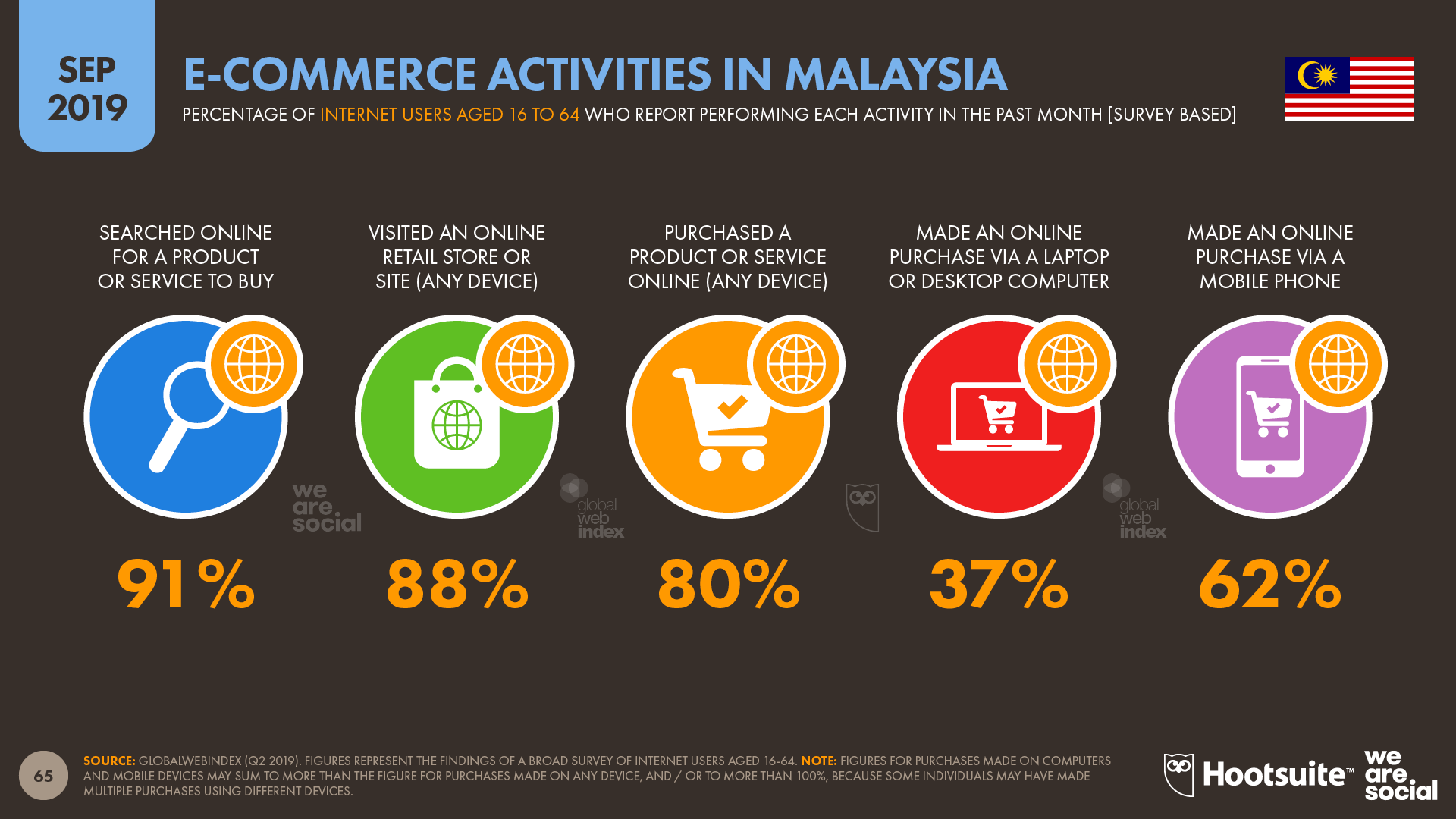

Total transaction value in the digital payments segment is projected to reach us 12 304m in 2020.

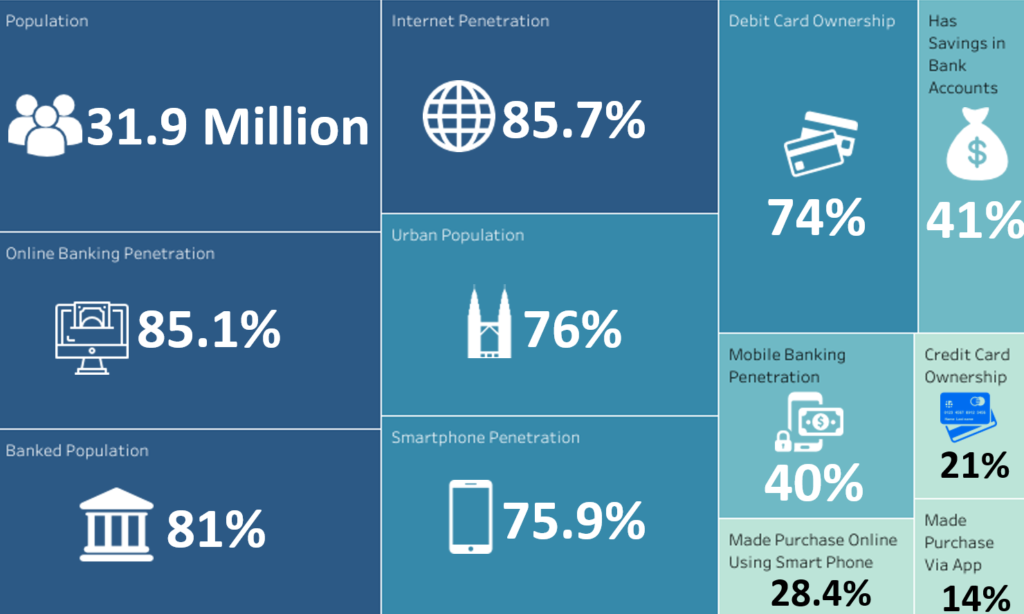

Mobile payment malaysia statistics. The digital payments market segment is led by consumer transactions and includes. Welcome to the fast link of the department of statistics malaysia official portal selamat datang ke pautan pintas portal rasmi jabatan perangkaan malaysia. Back in 2018 the distance was big enough that emarketer predicted the coffee giant would hold on to its lead into 2022 but apple pay enjoyed some faster than expected growth in 2019 to become the market leader.

Malaysian wechat users may then be rejoicing as wechat has confirmed that it will be rolling out its digital payment system wechat pay in malaysia in early 2018. Basic payments indicator. Department of statistics malaysia block c6 complex c federal government administrative centre 62514 putrajaya tel.

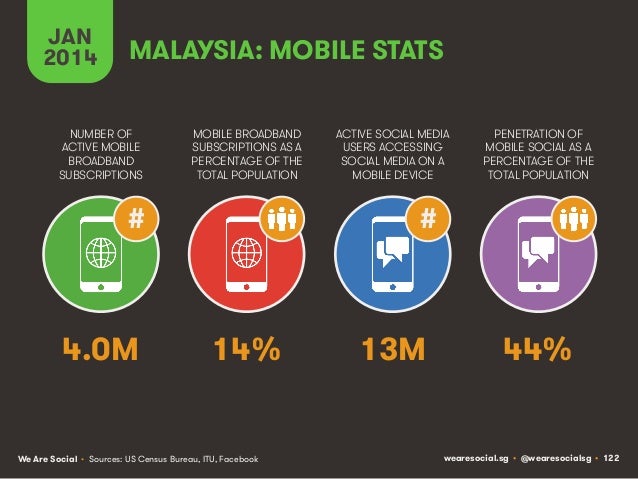

45 use of this method is forecast to continue to grow at a compound annual growth rate of 25 percent to 2021 when it is expected to retain its top position and account. Mobile payments have been so slow to take off in the us that until last year starbucks mobile app was the most popular mobile payment platform in the country. The mobile pos payments segment includes transactions at point of sale that are processed.

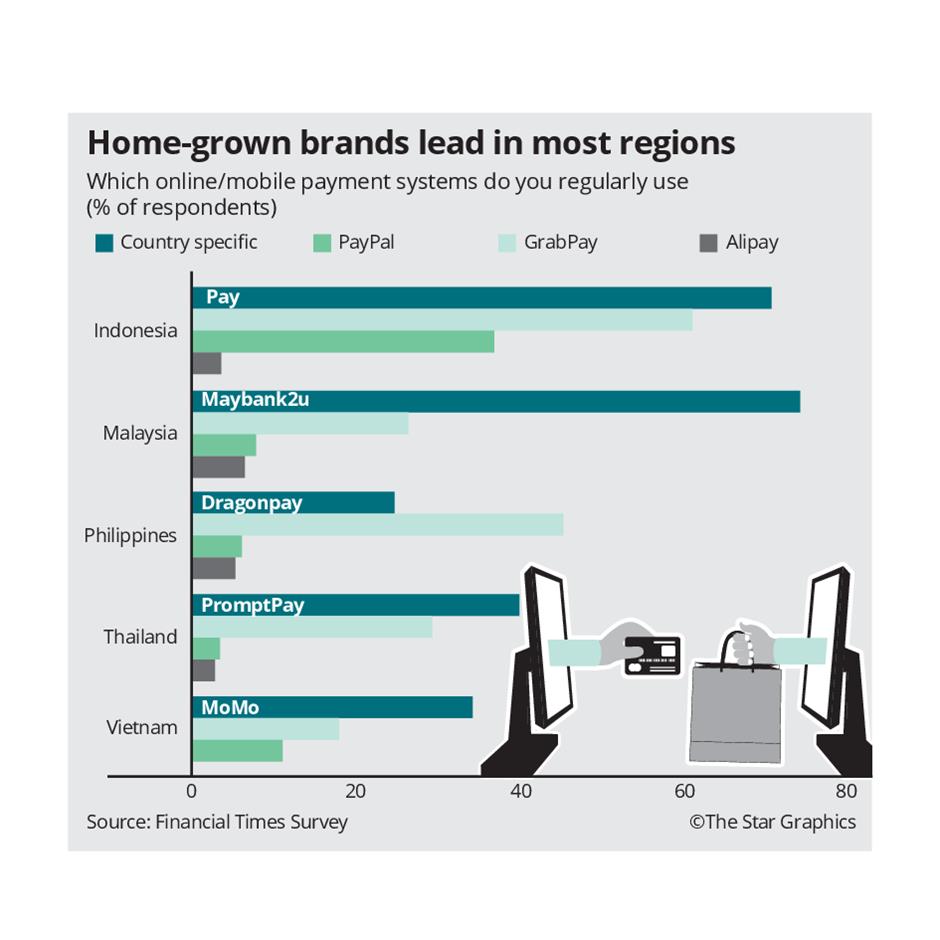

Bank transfers dominate as malaysia s preferred payment method. Mycensus 2020 portal portal banci 2020. Internet banking and mobile banking subscribers.

03 8885 7000 fax. Launched in 2011 wechat pay provides fast and reliable payment services to its users and has rapidly become one of the most popular mobile payment services in china. Volume and value of transactions.

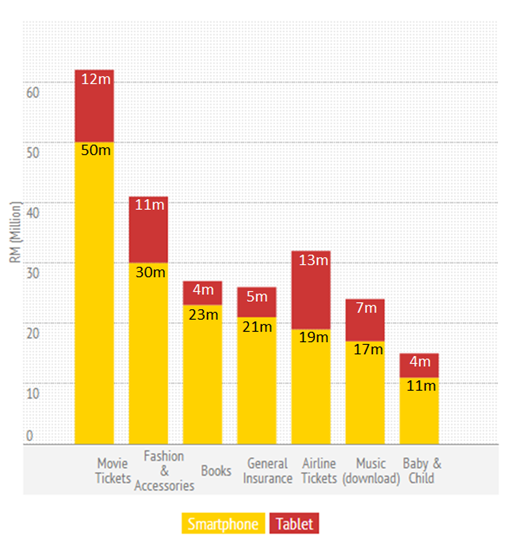

According to malaysia finance minister lim guan eng with the data sharing tax administrators would be able to catch tax evaders and monitor for compliance reported fmt. Latest statistics on payment instruments systems channels and payment machines. Bank transfers are the most used e commerce payment method in malaysia accounting for almost half 46 percent of all transactions or 1 8 billion in 2017.

Malaysia wants the world s mobile payment cashless companies to share financial data with governments to prevent money laundering tax evasion. Number of cards and users of payment instruments.