Monetary Policy In Malaysia

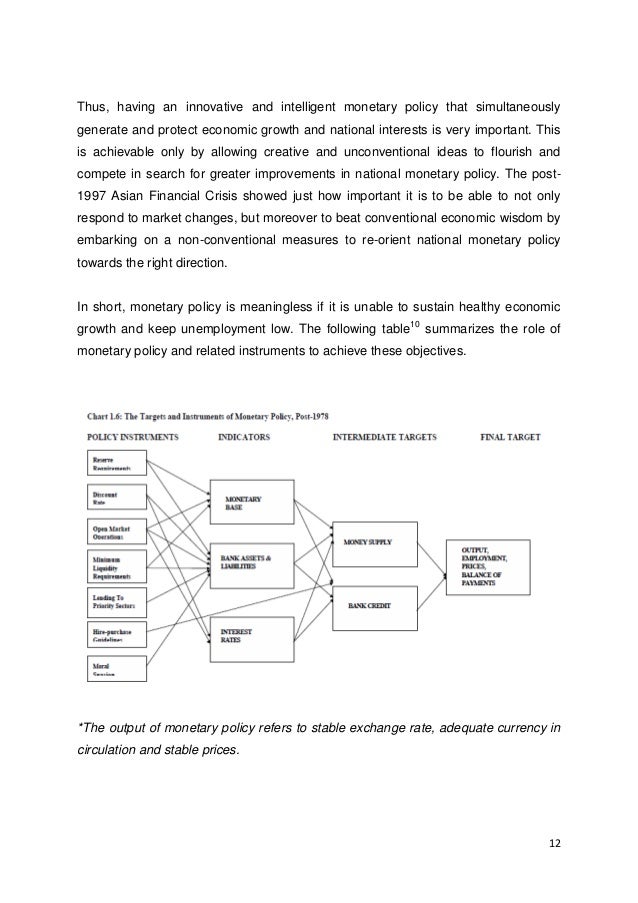

Monetary policy tools.

Monetary policy in malaysia. First they all use open market operations. In the wake of the collapse of the bretton woods arrangements in the early 1970s we ve seen the rise and fall of monetarism money base targeting and the spreading hegemony of interest rate targeting irt which involves using an intermediate target. Since the last monetary policy statement in october developments in the global and domestic inflation environment have led to a significant shift in singapore s cpi inflation outlook for 2015.

The ceiling and floor rates of the corridor of the opr are correspondingly reduced to 2 75 percent and 2 25 percent respectively. The decision came amid growing risks to the outlook from the coronavirus. Mas implements monetary policy by undertaking foreign exchange operations to keep the singapore dollar nominal effective exchange rate within a policy band consistent with ensuring price stability.

For instance the monetary authority may look at macroeconomic numbers like gdp and inflation industry sector. All central banks have three tools of monetary policy in common. This action changes the reserve amount the banks have on hand.

This past couple of years has been a fascinating laboratory for assessing the effectiveness of alternative strategies of monetary policy. The last time when monetary policy happens to change was during the malaysia s inflation period during 1998. They buy and sell government bonds and other securities from member banks.

This policy is intended to strengthen the foundation on which the prospect for sustainable growth in the medium and longer term would be enhanced. Mas also conducts money market operations to provide sufficient liquidity for a well functioning banking system and to meet banks demand for reserve and settlement balances. A higher reserve means banks can lend less.

Despite a slowdown in growth it is essential to maintain a tight monetary policy to contain inflationary pressures arising from the depreciation of ringgit. Whereby our money is downgraded to the peak level enforcing the government to increase the loan interest rate and effect the economic wholly regardless of discrimination in any race in as what the economic policy was. Maintain tight monetary policy.

At its 2 3 march meeting the monetary policy committee of bank negara malaysia bnm voted to lower the overnight policy rate opr by 25 basis points to 2 50 while the ceiling and floor of the opr corridor were reduced to 2 75 and 2 25 respectively. The move had been largely expected by market analysts and marked the fourth cut so far this year. At its meeting today the monetary policy committee mpc of bank negara malaysia decided to reduce the overnight policy rate opr by 25 basis points to 2 50 percent.

Likewise the ceiling and floor of the opr corridor were reduced to 2 00 and 1 50 respectively. Monetary policy is formulated based on inputs gathered from a variety of sources. That s a contractionary policy.