Money Market In Malaysia

1 2 investment objective strategy and policies 1 2 1 in vestment objective.

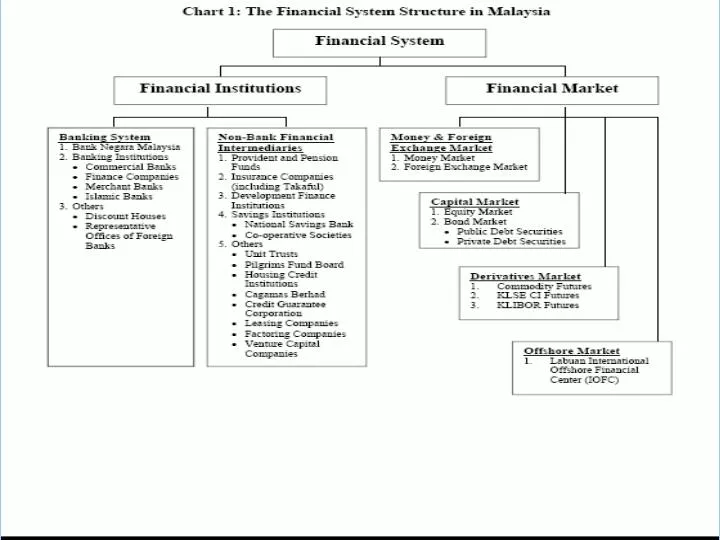

Money market in malaysia. Pidm s dis brochure for more enquiries. As the development of the money market reached a stage where supply of mtbs and mgs was no longer sufficient to meet the growing and diverse needs of the market ba and nid were introduced. Only short term money market deposit stmmd is protected by pidm up to rm250 000 for each depositor.

Drop us an email and we ll get back to you. Bankers acceptances bas negotiable instruments of deposits nids treasury bills. Rhb money market fund 4 1.

Jalan dato onn 50480 kuala lumpur malaysia. 1 1 3 financial year end 31 december. Fund information 1 1 basic information 1 1 1 name of the fund rhb money market fund.

In a repo or repurchase agreement the bank sells its money market instruments approved by bank negara malaysia to an investor with an understanding to buy back the instruments at an agreed price interest rate on a specific future date. 1 1 2 fund category money market fund. Features minimum investment rm50 000 usd 5 000 individual usd 20 000 company.

It is primarily used by governments and corporations to keep their cash flow steady and for. If for example an individual maintains 5 000 in a money market account that yields 3 annually and the individual is charged 30 in fees the total return can be impacted quite dramatically. Money market deposits eligible for protection by pidm long term investments invest in.

1 1 4 name of trustee hsbc malaysia trustee berhad. The securities commission malaysia requires at least 90 of the net asset value nav of a retail money market fund to be invested in short term bank deposits of less than six months fixed deposits fds of more than six months commercial paper and short term corporate bonds with maturities of not more than a year. Find a branch call us.

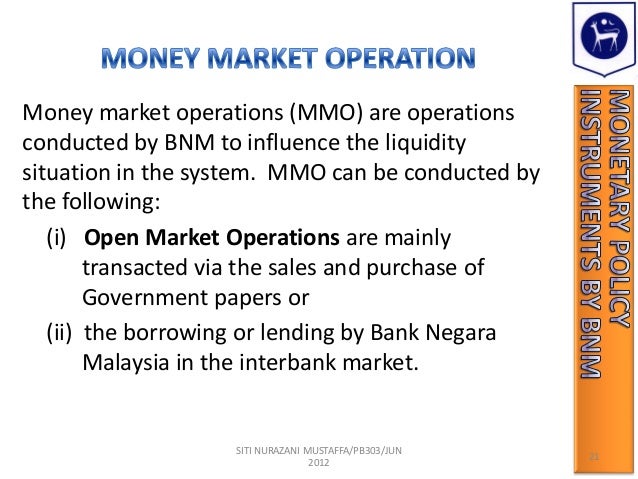

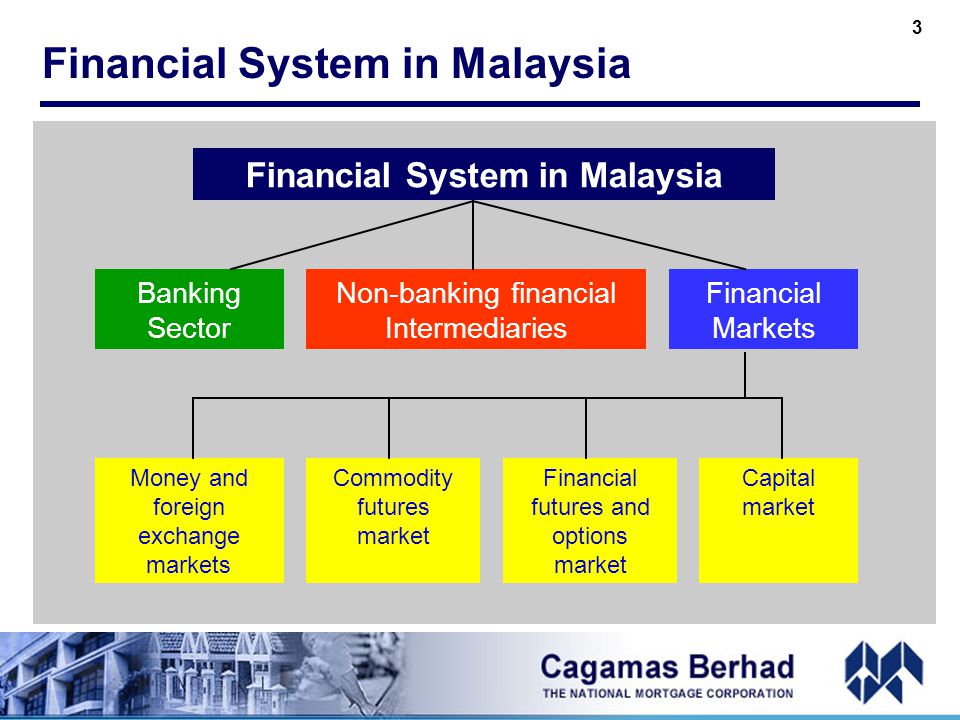

Email now talk to an expert. Capital markets the money market is defined as dealing in debt of less than one year. As malaysia s central bank bank negara malaysia promotes monetary stability and financial stability conducive to the sustainable growth of the malaysian economy.

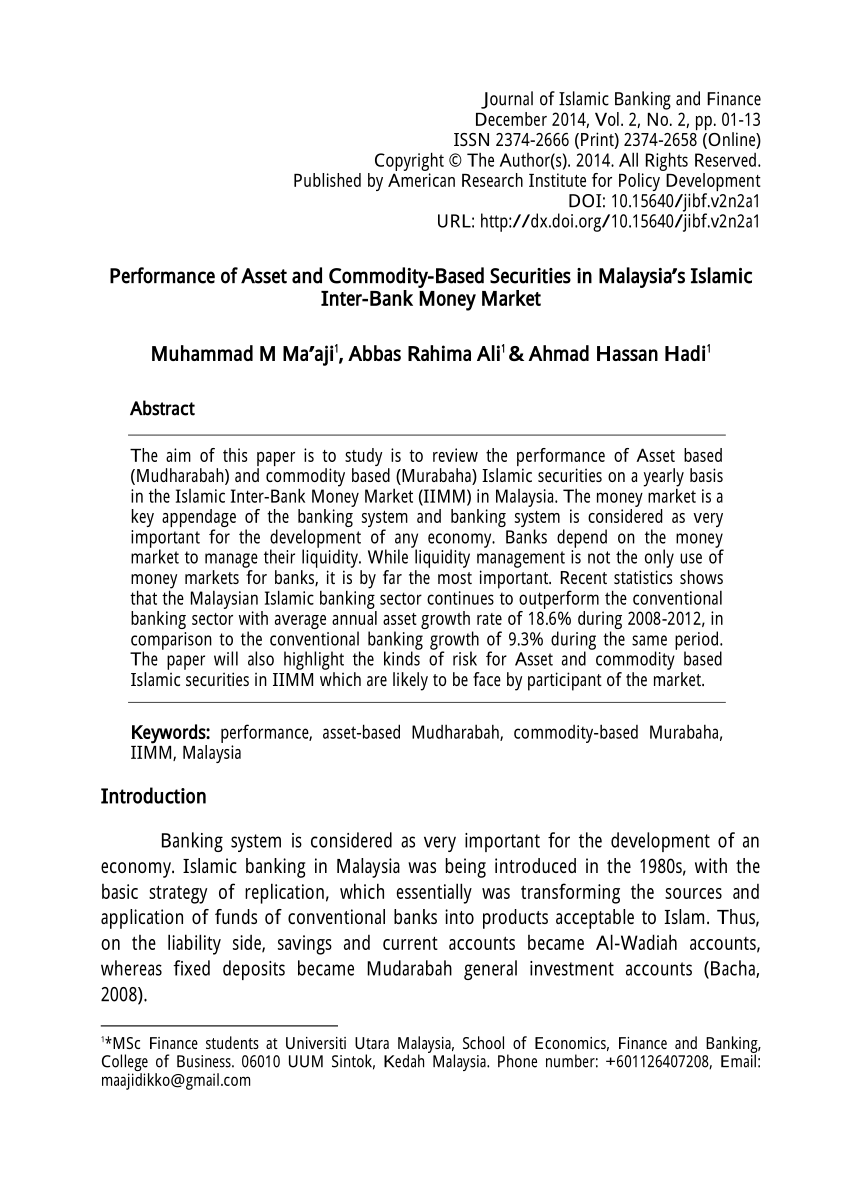

The strong demand for these two instruments reflected the shift of preference in favour of negotiability for deposits and risk free recourse in trade bills in the event of default. This is an islamic money money market instrument whereby the profit is determined upfront via a murabahah trade and payable on the maturity date together with the initial principal amount.